does idaho have capital gains tax

Box 36 Boise ID 83722-0410 Phone. States have an additional capital gains tax rate between 29 and 133.

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital gains are taxed as ordinary income in Idaho.

. Taxes Immigration Labor law Verified If you owned and used the property as a primary residence - the gain - up to 250000 for single. The capital gains rate for Idaho is. The land in Idaho originally cost 550000.

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held. 1 producing assembling fabricating manufacturing or processing any agricultural mineral or.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Idaho axes capital gains as income. Capital gains tax is the tax that you pay on those capital gains.

208 334-7846 taxrep. Idaho does not levy an inheritance tax or an estate tax. Capital Gains Tax Calculator 2022.

HB 449 would eliminate the state capital gains tax on the sale of precious metals. Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale. Does Idaho have an Inheritance Tax or an Estate Tax.

The District of Columbia moved in the. A real propertyheld for at least 12 months b tangible personal property used in a revenue-producing enterprise and held for at least 12 months a revenue-producing enterprise means. 500000 for married couple - will not be taxable.

Only capital gains from the following idaho property qualify. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. 1 producing assembling fabricating manufacturing or processing any agricultural mineral or.

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Dont include gains and losses reported on lines 2. Idaho doesnt have an estate or inheritance tax for.

A majority of US. 500000 for married couple - will not. Section 63-105 Idaho Code Powers and Duties - General Income Tax.

Here is a list of our partners and heres how we make money. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent. However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated.

208 334-7660 or 800 972-7660 Fax. Taxes capital gains as income and the rate is a flat rate of 495. State Tax Commission PO.

The capital gains rate for Idaho is. A real propertyheld for at least 12 months b tangible personal property used in a revenue-producing enterprise and held for at least 12 months a revenue-producing enterprise means. Up to 15 cash back Experience.

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more. Capital Gains Taxes. The land in Utah cost 450000.

The Idaho Income Tax. The table below summarizes uppermost capital gains tax rates for Idaho and neighboring states in 2015. Use Form CG to compute an individuals Idaho capital gains deduction.

The land in Idaho originally cost 550000. The percentage is between 16 and 78 depending on the actual capital gain. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

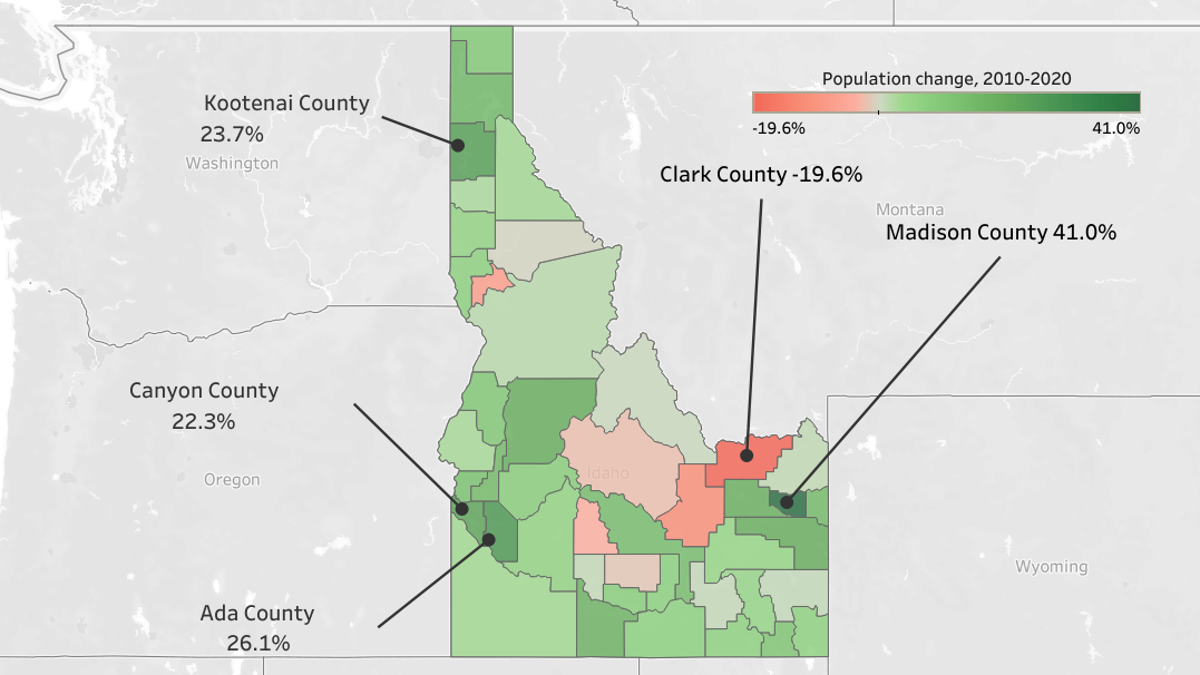

Precious metals in bullion form are a constitutional form of money and should be treated as such when it comes to taxation. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Idaho. 100000 gain x 5500001000000 55000 For tangible personal property Days the property was used in Idaho Days the property was used everywhere.

Only capital gains from the following idaho property qualify. Please remember that the income tax code is very complicated and while we can provide a good estimate of your Federal and Idaho income taxes your actual tax liability may be different. Capital gains for farms is.

States have an additional capital gains tax rate between 29 and 133. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows. The rate reaches 693.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. The rates listed below are for 2022 which are taxes youll file in 2023.

Idaho Remains Fastest Growing State Utah Second News Tetonvalleynews Net

Top 4 Renovations For The Greatest Return On Investment Infographic Infographic Investing Renovations

The Ultimate Guide To Idaho Real Estate Taxes

Historical Idaho Tax Policy Information Ballotpedia

Greater Idaho May Expand To The Ocean As 3 Oregon Counties Vote In May R Idaho

Idaho Tax Forms And Instructions For 2021 Form 40

Idaho Estate Tax Everything You Need To Know Smartasset

Where Upper Middle Class People Are Moving Upper Middle Class Middle Class Financial Advice

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Mapsontheweb Kansas Missouri Los Angeles North Washington

Idaho State 2022 Taxes Forbes Advisor

Capital Gains Tax Estimator East Idaho Wealth Management

Guide To Combined Reporting Idaho State Tax Commission

Idaho 529 Plan And College Savings Options Ideal College Savings Plan

Capital Gains Tax Idaho Can You Avoid It Selling A Home